Microsoft Keeps Performing Very Well - But Don't Get Fooled

Summary

Microsoft keeps executing on its mobile and cloud-first strategy.

The big earnings surprise was based on another item though.

Microsoft remains attractive; shares are not too expensive yet.

Microsoft (MSFT) continues to exceed expectations, but its big earnings beat was not only based on strong execution, but also on an unexpected tax item. The outlook for the company and its shareholder returns make Microsoft's shares pretty attractive nevertheless.

Microsoft's fourth quarter results, which the company reported on Thursday evening, started with a big beat on the bottom line:

Instead of a forecasted $0.71 per share, the company earned a very impressive $0.98 per share, whilst its revenues grew by almost double digits.

Instead of a forecasted $0.71 per share, the company earned a very impressive $0.98 per share, whilst its revenues grew by almost double digits.

Let's take a closer look at those results:

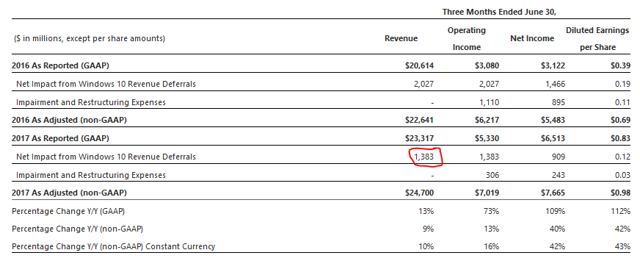

When we look at the company's results, we see that the company's GAAP revenues and non-GAAP revenues differ by about $1.4 billion, which is unusual, as most companies only adjust their bottom line.

When we look at the company's results, we see that the company's GAAP revenues and non-GAAP revenues differ by about $1.4 billion, which is unusual, as most companies only adjust their bottom line.

In Microsoft's case, there is a good reason for that adjustment though: The company's Windows 10 revenues are, under GAAP, not recognized at the time the license is sold, but ratable as the license is used. Since it is a sure thing that Microsoft will earn those revenues (in the accounting sense of the word) in the near future, it makes sense to include those revenues in Microsoft's results. The company will adopt a new revenue standard starting this quarter, which will lead to those revenues being recognized at the time of billing; thus, those adjustments likely won't be needed in the future any longer.

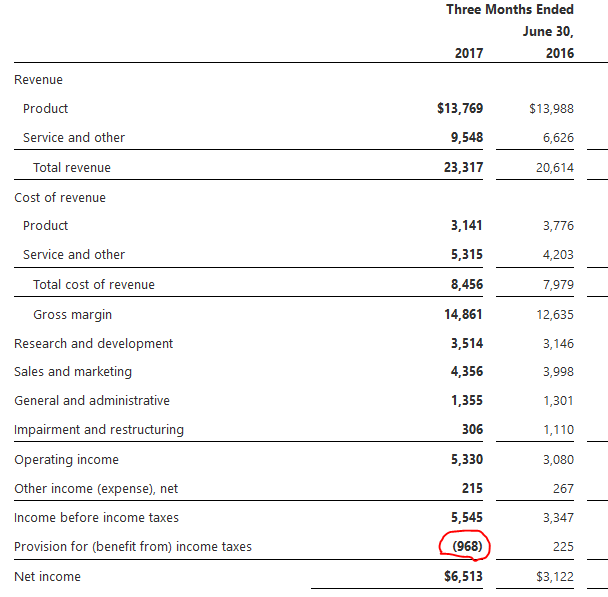

In the image above, we also see that Microsoft's fourth quarter net earnings were higher than its operating earnings, both on a GAAP basis as well as on an adjusted basis: This is partially due to the impact of Microsoft's high cash holdings, which generate some return, but the most relevant factor here are the taxes the company has to pay:

We see that Microsoft paid no income taxes during the most recent quarter, the actually hot almost $1 billion back on a net basis - this lifted the company's net income substantially, which was the reason for Microsoft's very big earnings beat - the company earned about 30% more than expected in the most recent quarter.

When we adjust Microsoft's net income with a tax rate of 15% (Microsoft's effective tax rate over the last year), we get to GAAP net earnings of $4.7 billion, which is equal to $0.60 per share.

Since we already recognized that the adjustments Microsoft makes make sense, we can also calculate what Microsoft's non-GAAP earnings would have looked like with a 15% tax rate: The result is still pretty good; the company would have earned $0.76 per share if the tax rate would have been fifteen percent. Since analysts forecasted $0.71 in non-GAAP earnings per share, Microsoft would have handily beaten estimates even without a big tax benefit.

Microsoft is not only attractive due to its strong growth and high profitability, but also due to its big cash hoard and strong cash generation: During the most recent quarter, the company produced operating cash flows of $11 billion, which lead to a quarterly free cash flow of $8.7 billion (after subtracting $2.3 billion in capex).

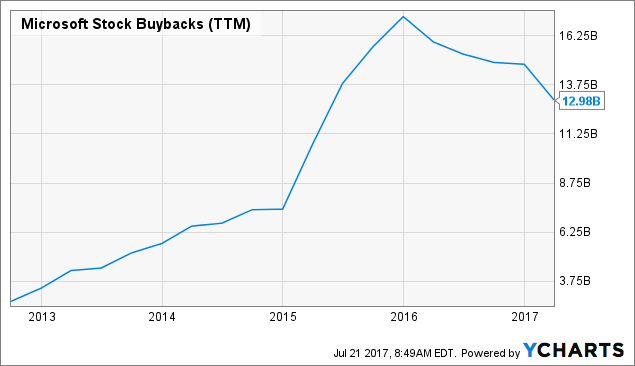

With huge cash flows like that, Microsoft can easily finance an attractive dividend and substantial buybacks at the same time:

MSFT Stock Buybacks (TTM) data by YCharts

MSFT Stock Buybacks (TTM) data by YCharts

Microsoft has been buying back shares for billions of dollars each year for a while now, but has slowed down its pace a bit over the last quarters. During the most recent quarter, Microsoft only spent $1.7 billion on buybacks, which could be based on either of two things:

- The company's shares have performed very well over the last years, and maybe the company's management sees them as somewhat less attractive than in the past, thus spends less on buybacks.

- The company waits for a tax holiday so it can repatriate its cash hoard to finance buybacks, and until this happens, the company only uses the cash that is available in the US for shareholder returns.

Due to the stock buyback pace having slowed down somewhat, its impact is smaller than it was a couple of years ago, but the company's share count keeps shrinking at a substantial pace, which allows for additional EPS growth.

When we look at Microsoft's business, we see that Azure, its main cloud product, once again was a very strong performer: Revenues increased by a whopping 97%, far outpacing the cloud growth rates at peers such as Amazon (AMZN) or IBM (IBM). LinkedIn contributed $1.1 billion to Microsoft's revenues, about 4.5% of the total - when we look at the price Microsoft paid for LinkedIn ($26 billion) versus the company's market cap ($565 billion), we get almost exactly the same ratio. It thus looks like Microsoft neither overpaid nor underpaid for its acquisition of LinkedIn.

Phone sales continue to drop, which is not a negative, as Microsoft's focus on software and services allows for higher margins with less capital commitment: Earnings growth outpaces revenue growth, and at the same time, capex requirements drop, which allows for even better cash flows for the company (and ultimately, its owners).

MSFT Price to Free Cash Flow (TTM) data by YCharts

MSFT Price to Free Cash Flow (TTM) data by YCharts

At 20.5 times free cash flows, and 19.6 times forward earnings, Microsoft is not trading at a cheap valuation, but the company's shares are not overly expensive either: This looks like a fair to attractive valuation for a high class company that keeps growing, has a big moat, attractive shareholder returns and probably the best balance sheet in the world.

Takeaway

Microsoft's latest quarter was another success; the company's cloud and mobile focus is paying off in a big way. We nevertheless should look at the fact that the big earnings beat was a product of a one-time tax item, adjusted for that, the earnings numbers still look pretty good, but less outstanding.

With strong growth, strong margins, high shareholder returns and a valuation that is not too high, Microsoft still looks attractive, I believe.

Author's note: If you enjoyed this article and would like to read more from me, you can hit the "Follow" button to get informed about new articles. I am always glad to see new followers!

No comments:

Post a Comment