How Much Is Alibaba Really Worth?

Summary

Earlier this month, Alibaba announced another quarter of solid financial results.

Since the beginning of the year, Alibaba shares have added almost 100 percent.

Despite the rally, two popular valuation techniques suggest that Alibaba still has a long way to go.

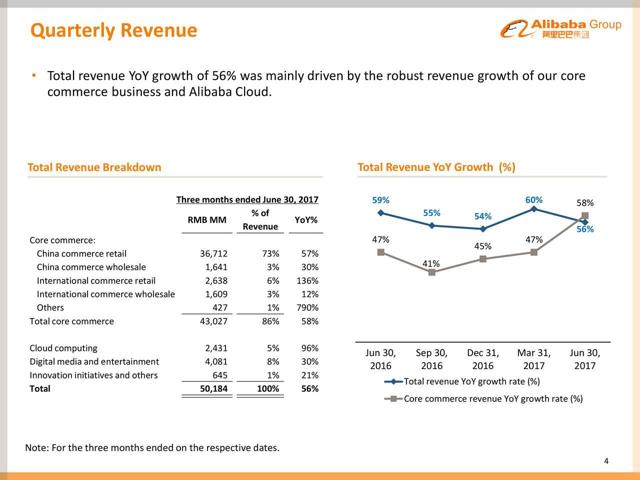

Nearly two weeks have passed since Alibaba (BABA), Chinese e-commerce powerhouse, announced its 2017 first quarter financial results, which again crushed all analyst expectations. Year-over-year, total revenue in the first quarter grew 56 percent to RMB 50,184 million and non-GAAP diluted EPS increased 65 percent to RMB 7.95. As can be seen below, the growth came primarily from the company's accelerating core commerce business and cloud computing division, which is one of the fastest growing segments.

Source: Q1 earnings presentation

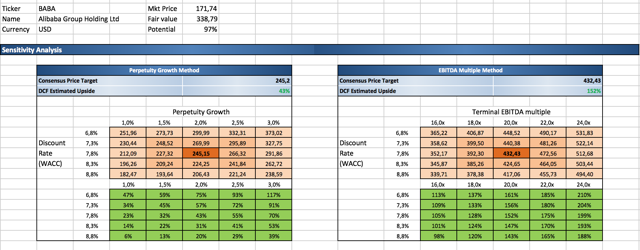

Source: Q1 earnings presentationDiscounted Cash Flow Analysis

Based on my up-to-date simple DCF blended model, Alibaba's shares are currently trading with almost 97 percent upside potential. Under the perpetuity growth method, the fair value of the stock is $245.2, assuming 50 percent revenue growth over the next five years, stable EBIT margin and terminal growth rate in perpetuity of 2 percent. Under the EBITDA multiple approach, the intrinsic value stands at $432.4 if we assume that the appropriate exit EV/EBITDA multiple is around 20.

Pros & Cons Of The Method

- As DCF is one of the most widely used valuation methods, it tends to provide one of the most reliable estimates of a stock’s intrinsic value.

- It isn’t significantly influenced by short-term market fluctuations or non-economic factors.

- Because DCF relies on free cash flows, which are generally harder to manipulate, it is considered to be free of subjective accounting policies.

- Since it is a valuation tool that is heavily dependent on assumptions, even a small change in valuation inputs (e.g. the discount rate, terminal growth rate) can translate into a big difference in the estimated fair value of the company.

- Forecasting future cash flows can be a very challenging task, especially if the company is not profitable or suffers from a lack of transparency.

- DCF valuation is a moving target: If the company's outlook change, the intrinsic value will change accordingly.

No comments:

Post a Comment